Is It Time To Scrap Stamp Duty?

The Home Owners Alliance believe the UK Government should scrap the Stamp Duty Land Tax... But are they right?

What is Stamp Duty Land Tax?

Introduced by William III and Mary II in 1694, the concept of a Stamp Duty tax was created to help fund England's efforts in the Nine Year War with France. The new taxation proved to be so successful that instead of only lasting the 4 years it was meant to, it continues to this very day through the means of other Stamp Acts.

Fast forward to the 1950s, the then UK government introduces a Stamp Duty Tax on property transactions known as the Stamp Duty Land Tax (SDLT). At this point, the average UK property cost £20,000 and SDLT was payable at 1% only if the property purchase was £30,000 or above. This meant that very few property purchases were eligible for the taxation and, if they were eligible, it was only 1% of the purchase price.

Since then SDLT rates and thresholds have increased and decreased. Most recently, in an (arguably successful) attempt to stimulate the UK property market during a global pandemic, Chancellor Rishi Sunak introduced a stamp duty holiday for transactions up to the £500,000 threshold. Although the holiday has since ended, it begs those to ask... should SDLT be scrapped?

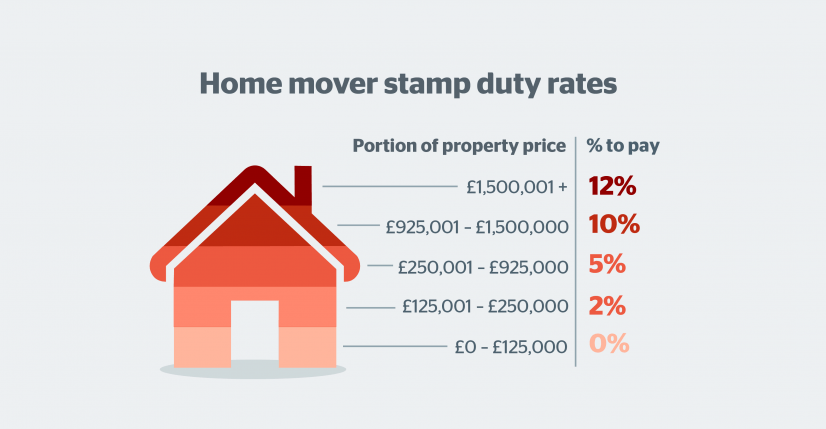

Current SDLT rates and thresholds for homebuyers in 2022 (source: Which.co.uk).

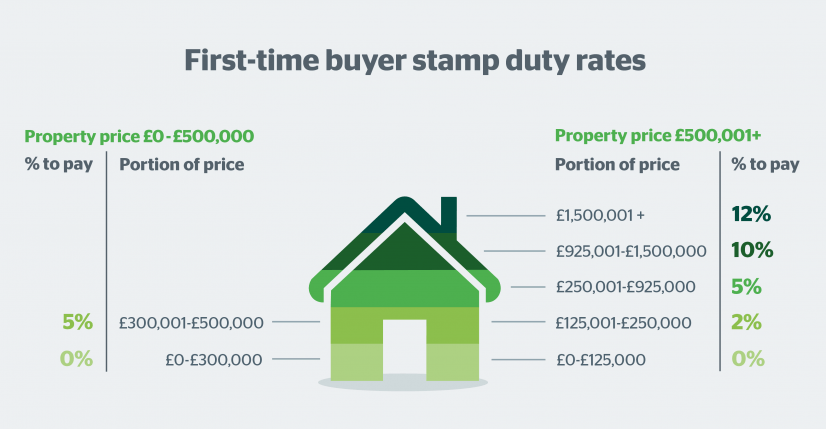

Current SDLT rates and thresholds for first time buyers in 2022 (source: Which.co.uk).

Why Should it Be Scrapped?

To understand the effect of SDLT better, think of this example:

- You look to move and buy a new house worth £1,000,000.

- For the first £125,000 of the purchase, you pay 0% (£0) in tax.

- For the next £125,001 to £250,000, you pay 2% on a taxable sum of £125,000 (£2,500).

- For the next £250,001 to £925,000, you pay 5% on a taxable sum of £675,000 (£33,750).

- For the next £925,001 to £1,500,000, you pay 10% on a taxable sum of £75,000 (£7,500).

In the example above, you pay an additional £43,750 in SDLT payments (4.375% of the total purchase price). These large additional costs to purchasing property cause many homeowners to delay or think twice about moving house.

Scrapping SDLT could help bring down the under-occupation rate (the percentage of houses with two or more unoccupied bedrooms) by allowing older homeowners to downsize more easily, therefore freeing up more appropriate housing for larger families. An increase in movement up and down the property market would allow more prospective buyers to access the market and help to stabilise unsustainable house price growth without a crash.

On the other hand, data from Statista.com suggests that the SDLT brought in £14,098,000,000 in UK tax receipts between April 2021 and April 2022. This amounted to 1.96% of the total tax receipts for the same year and, therefore, this is a significant portion of revenue for the UK government. For that reason, it's hard to see Downing Street scrap the system entirely.

Of course, removing SDLT from property transactions would benefit everyone purchasing property immensely. However, it's highly unlikely that the UK government will want to part with that amount in tax receipts. Therefore, if anything were to change, it wouldn't be surprising to see SDLT being replaced by a different form of tax (e.g. Capital Gains).